Business Consulting

What We Do - Business Transformation Projects

Idea outline/Business case

We can help you to create a compelling business case which will critically examine and justify your decision to go ahead with your project.

Stakeholder Management

A good initiative initiative is not guaranteed to succeed simply because the idea is great. Any project will be doomed before take-off if stakeholders are not onboard.

e2e Project Management

We can help you to get your proposed project signed off and also Project Manage your initiative from kick-off, all the way through to benefits realisation.

Business Process Engineering

Your business process will affect customer satisfaction, staff morale and therefore profitability. We employ various tools including Lean 6 Sigma to perform end-to-end process analysis to uncover any gaps and take advantage of any opportunities to make your operations slicker and more efficient.

Requirement Engineering

80% of projects fail because the business expectation is not properly understood by the delivery team. We are specialists at capturing business requirements, documenting and presenting them in a way that enables a vivid understanding of business requirements.

Research and Analysis

No two projects are ever the same; that is why we never 'cookie cut' our solutions. We analyse your requirements and research possible solutions, from which we select an optimal solution for your business problem.

Data Analysis

Data is key to the success of any business. We provide business insight from your system data, using different various reporting formats to provide you with objective information to inform your business decisions.

System Analysis and Design

We analyse and design systems, both front-end user interface and back-end databases to ensure great user experience and efficient data management.

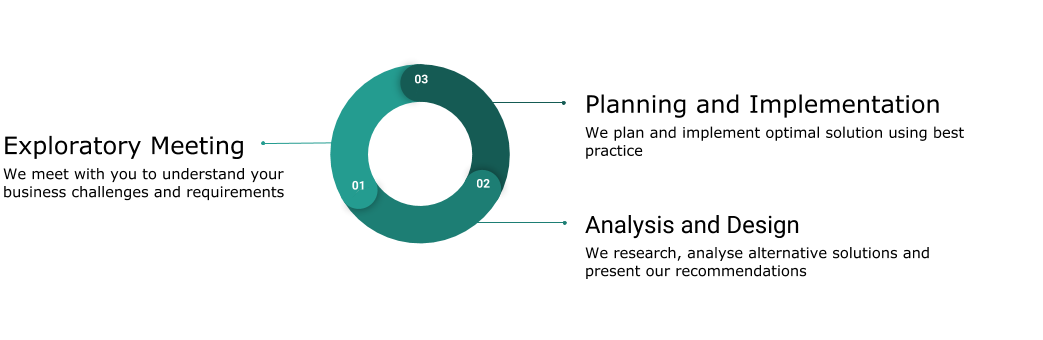

How we do it

What's in it for you

Bookkeeping

Good bookkeeping is the basis of all accounting however, allocating valuable time to routine bookkeeping can be a challenge.

That’s one task we can perform for you.

You get your own dedicated accountant assigned to your business.

The rest is in two simple steps:

You provide transaction data

Xero can automaticaly collect transaction information or you can upload your transactions to Xero or simply email them to us.

We code and update database

We record your transactions into our accounting software, from where we can provide you with management information as required.

We will ensure that your chart of accounts and your accounting transactions are professionally kept, in order to reduce risk of HMRC challenging your accounts and tax returns.

VAT Accounting

We understand that VAT can be a confusing topic for a small business. For this reason, we are keen to provide the necessary support to our clients, carefully advising them on the VAT options available and which would be most beneficial to them. In the event of HMRC investigation, we are available to represent and act on your behalf free of charge.

Our VAT services

VAT Review

We will assess your VAT situation to determine the most beneficial VAT scheme for your business. Then we can advise you on how to make your business more VAT efficient.

VAT Returns

We compute your VAT payable to (or claimable from) HMRC and check in with you. Once you okay us to proceed, we will then submit your VAT returns to HMRC.

HMRC Representation

HMRC investigations are quite common, so in the event of any HMR investigation into your VAT affairs, you can rest assured that you're not on your own. We will act on your behalf.

How it works

- We collect your transactions for your VAT accounting period.

- We compute your VAT liability/refund and validate with you.

- If agreed, we make a digital submission of returns to HMRC.

- For any HMRC queries, we will represent you free of charge.

Accounting

Allocating valuable time and resources to routine bookkeeping and accounting can be a challenge but don’t worry, we’re here to help relieve you of that burden. But we don’t stop at producing accounts, we help our customers with important business insight using specialist tools.

What we offer our clients

Dedicated accountant

Your business will be assigned its own accountant and because we are a small firm, you will have unimpeded access to senior partners.

Accounting health check

Once we have established your specific requirements, we set up appropriate accounting procedures and controls to ensure your accounts are kept up-to-date and in compliance with statutory regulations.

Key performance indicators

- Profitability

- Cashflow

- Customer activity

- Credit control

- Business intelligence analysis

Filing is included

For sole traders, contractors and freelancers, we will complete your accounts and submit your Self Assessment tax return, ensuring your business stays compliant with HMRC.

For Limited Companies, we complete and submit your annual accounts, Corporation Tax return, Confirmation Statement and up to two director’s Self Assessments.

Deadline reminders

We appreciate that while you are busy running your business day to day, it is easy and quite common to forget your statutory accounting deadlines. We send you email reminders when your accounts and returns are due to be submitted, helping to ensure you don't miss that deadline and so avoid financial penalties.

Free company formation

You've just had that business inspiration and can't wait to take on the world. Now all you need is someone to help you navigate the options available to you in terms of company structure and then with your company formation. We can do that for you. In return, you must commit to signing up with us for the first 12 months after incorporation.

Payroll

Our payroll process is stress-free and accurate so that you can concentrate on growing your business. Once we have established and set up standing data for your business, our recurring process is simple:

You provide pay details

You provide us at the end of each pay period with pay details which your employees have worked.

We process payroll

We process your payroll, then send out payslips and a summary of how much to pay your employees and HMRC

We submit payroll return

Once we’ve received your approval, we’ll submit your RTI return to HMRC.

We process starters, leavers, calculate holiday pay, Statutory Sick Pay, Statutory Maternity Pay, student loan deductions and workplace pensions.

Taxation

Here at Pneuma Partners, our priority is to make your business tax efficient and at the same time ensure you are compliant with HMRC requirements.

With this in mind, we calculate and submit the following in a timely manner.

Income Tax and Corporation Tax

Corporation tax represents a substantial part of your trading costs.

Efficient corporate tax planning can result in potentially significant improvements in your bottom line.

We will help you to:

- Determine the most tax effective structure for your business

- Make the most of tax opportunities specific to your industry

- Meet the demands of tax compliance

- Take advantage of tax relief opportunities

- Reduce tax on disposals and maximise relief on acquisitions

- Acting on your behalf in discussions with the tax authorities

Self Assessment

We complete self assessments for up to 2 company directors.

We would love to help

Our pride is in our contribution to your success.